Create a high quality invoice now!

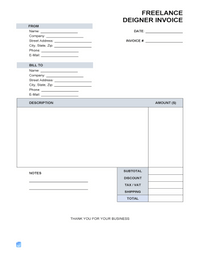

Make an Invoice NowThe freelance service invoice is for billing any type of product delivered or service provided on an individual basis detached from any company or other association. Commonly referred to as a ‘freelancer’ or ‘independent contractor’, will be responsible, after the invoice is paid, to deduct their share of withholding tax for State and Federal (IRS) tax purposes.

- Products – Payment is due upon delivery of the finished product to the client or customer.

- Services – Payment is due upon completion of the project or on a recurring basis (e.g. weekly, monthly, etc.).

Freelance Invoices

Table of Contents

- What is a Freelancer?

- How to Become a Freelancer

- How to Send an Invoice as a Freelancer

- Freelancer Tax Calculator

What is a Freelancer?

A freelancer is a self-employed professional that is experienced in a specific field of work that companies, startups, and individual clients may need one-time or seasonal help, although, do not have enough work to warrant hiring on a full-time basis. The services freelancers offer are often very desirable due to the hiring entity not having to reimburse expenses, pay for insurance, or pay for sick / vacation time. Not to mention their flexibility and ability to work remotely. While freelancers typically account for this by charging slightly higher rates compared to salaried employees working the same job, the convenience offered to employers often outweighs the increased expenses.

How to Become a Freelancer

To become a freelancer, one must have a skill and/or an education in a field or specific task that is often desired by employers. For example, an engineer with a degree and many years of experience may wish to offer their skills in the form of consulting. Another example may be a professional writer that wishes to write on a freelance basis for blogs, news sites, content publishers, and other online companies. Once the freelancer has identified their marketable service, the next step is to market themselves on one (1) or more freelance jobs sites.

Popular platforms used for freelancers include UpWork, Fiverr, Toptal, and Freelancer. Upon landing their first gig, it is very important that they perform exceptionally to ensure they receive good reviews. While excellence should always be strived for, it is especially important in the beginning as one poor review can cause other potential hirees to look elsewhere. After building up a repertoire of good reviews and building connections wherever possible, the freelancer can start to increase their rates. Essentially, the more desirable/competitive the freelancer’s services become, the hirer the rates they can justify charging. Overall, the general path to becoming a freelancer is as follows:

Identify marketable skills –> Apply for jobs on freelance sites –> Work –> Earn positive reviews –> Increase rates

How to Send an Invoice as a Freelancer

The requirements for creating and sending an invoice for hourly or fee-based freelance work is very similar to that of any other invoice. Structurally, both require the use of tables to arrange charges as well as fields to list contact information. However, due to freelance work being more personal in nature than services provided by companies, it is recommended that freelancers include less rigid terms as well as adding personal customization where applicable. Adding an invoice cover sheet can offer freelancer’s a convenient means of adding personalization while simultaneously informing the client of important information such as due dates, terms, and any other notes regarding the service.

Freelance Tax Calculator

Using an internet calculator to determine the monetary value of taxes that have to be paid in a given year can simplify the process greatly, while simultaneously reducing the likelihood of making a computational error. The following calculators can be used for calculating taxes:

United States Tax Calculator

- CalcXML’s – Self-Employment Tax Calculator