Create a high quality invoice now!

Make an Invoice NowThe hourly billing invoice is used when paying for a service on a per hour basis. Companies that charge customers hourly for their services will use this invoice to request payment at the end of a billing cycle that includes a calculation of all hours worked.

Table of Contents

Hourly Billing Rates

Two of the most common services that are paid for on an hourly basis are CPAs and attorneys. This is due to the fact that both are expensive services and to limit costs, most customers prefer to pay on an hourly basis.

CPA

A certified public accountant is someone who helps others with calculating their taxes. Filing taxes is a huge responsibility and should not be taken lightly. However, since filing only happens once per year (April 15th) for most people, a CPA is hired on a per hour basis to complete a filing.

- Hourly Rate: $34.40/hour (source: BLS)

Attorney

Depending on the type of attorney, expensive bills can rack up quickly. Attorneys typically charge a retainer fee, which is a deposit to ensure payments can be made. If not charging per hour, attorneys will take a case and work on contingency (when an attorney takes a percentage of the money awarded to their client after winning a case).

- Hourly Rate: $59.11/hour (source: BLS)

Hourly Pay Calculator

An hourly pay calculator can be handy when needing to calculate the hourly pay multiplied by the number of hours worked.

Example

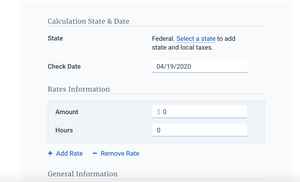

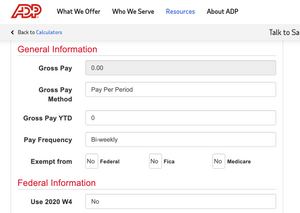

To find out the hourly pay of someone making $50,000 per year working 40 hours per week which would equate to $24.04 ($50,000 divided by 52 weeks, then divided by 40 hours). The following calculators are helpful for business owners when calculating an employee’s paycheck and having to factor in state taxes.

Calculators

PayCheckCity Hourly Pay Calculator

ADP Hourly Paycheck Calculator