Create a high quality invoice now!

Make an Invoice NowA direct deposit invoice is used for a product or service that is to be paid via ACH instructions by the billing party. This is common if an independent contractor is to be paid on a recurring basis with payment transferred directly to their bank account. A standard direct deposit authorization form should accompany the invoice with the billable party’s signature.

Table of Contents

What is Direct Deposit?

A direct deposit is a way of depositing a check into a person’s bank account without having to physically go into a bank each time to deposit a check. A direct deposit electronically transfers funds into another person’s bank account and once the process is set up, direct deposits can continually be a method of payment. Direct deposits offer a faster and more secure way to send funds than using a check. Direct deposits are widely popular when doing the following:

- Employers paying employees automatically and seamlessly on-time every week.

- The U.S. Treasury depositing social security checks in senior citizens’ bank accounts.

There are companies, like Quickbooks for example, that specializes in setting up businesses with the ability to offer direct deposit services for their employees.

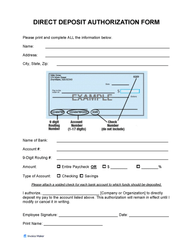

Direct Deposit Authorization

A direct deposit authorization form allows an employee to be paid directly to their bank account by their employer.

Download:

Requirements

Depending on the bank the following will be required to be included:

- Account Holder’s Name;

- Mailing address;

- Bank Name;

- Account Number;

- Routing Number;

- Signature; and

- Other Details (if required): Swift (BIC) or IBAN.

Helpful Tips

- Banking information (account and routing number) should always be taken from a bank check and NOT from a deposit slip.

- ACH transactions must be able to be accepted. Problems usually occur when depositing to bank accounts not located in the United States.

- If direct depositing to a savings account, double-check with the bank to verify the correct account and routing number.

- Money market accounts should be treated the same as checking accounts when making deposits.

How Long Does Direct Deposit Take?

Once deposited, a direct deposit can be seen immediately within the receiver’s account but depending on the bank, the time it takes to process and clear varies. Normally it should not take anymore than 1 or 2 days for a direct deposit to clear (the ability to withdraw funds).