Create a high quality invoice now!

Make an Invoice NowAn invoice is a payment request for products or services that outlines the price and amount for each item. Invoices are generally ‘due upon receipt’ even though most businesses allow up to 30 days to pay before charging late fees.

Contents

- Invoice Templates: Blank

- Invoice Templates: By Type (18)

- What is an Invoice?

- Are You an Employee?

- How to Make an Invoice

- How to Write an Invoice

- Maximum Late Fees | Penalties

- How Long to Keep an Invoice

Blank Templates

By Type (18)

What is an Invoice?

An invoice is a document that outlines service or goods provided in exchange for payment or trade. The party requesting payment (“payee”) creates the invoice writing their details, client’s details, description of goods or services, and the total amount owed. The preferred payment method should be included and once complete should be sent to the client (“payer”) via e-mail, standard mail, or text message.

Invoice Cover Sheet – For a more professional look and acts as a Table of Contents for the itemized list of charges.

History

The oldest known human writing is actually a 7,000 year old sales receipt. While we know the sales receipt was for clothing, the oldest known form of payment was made in beer in the same ‘cuneiform’ writing.

Is Shipping Taxed?

Most likely no but depends on the final destination of the product. For example, in the USA shipping is taxed in about half the States as long as the shipping charge is separate from the sale (see table below).

| State | Shipping Taxed? | Source |

| Alabama | Not subject to sales tax if the shipping charges are listed separately on the invoice. | Admin Code 810-6-1-.178 |

| Alaska | No sales tax. | N/A |

| Arizona | Not subject to sales tax. Handling charges are taxed. If shipping and handling, the entirety is taxed. | Admin Code § R15-5-133 |

| Arkansas |

Subject to sales tax. |

GR-18 |

| California | Not subject to sales tax if the shipping charges are listed separately on the invoice. |

Publication 100 (Shipping and Delivery Charges), Article 12 Regulation 1628 |

| Colorado | Not subject to sales tax if the shipping charges are listed separately on the invoice. | Colorado Sales Tax Guide (Page 10) |

| Connecticut | Subject to sales tax. | Page 13 of IP-2018(5) |

| Delaware | No sales tax. | N/A |

| Florida | Not subject to sales tax if the shipping charges are listed separately on the invoice. | Sales Tax Rules 12A-1.045, FAQ from FL Dept. of Revenue |

| Georgia | Subject to sales tax. | § 48-8-2(34)(A)(iv) |

| Hawaii | Subject to sales tax. | § 237-3 |

| Idaho | Not subject to sales tax if the shipping charges are listed separately on the invoice. | tax.idaho.gov (Retailers), § 63-3613(b)(7) |

| Illinois | Subject to sales tax. | Nancy Kean vs Wal Mart Stores Inc., § 130.415(b)(1)(D)(ii) |

| Indiana | Subject to sales tax. | § 6-2.5-1-5(a)(4) , Commissioner’s Directive #23 (top of Page 2 |

| Iowa | Not subject to sales tax if the shipping charges are listed separately on the invoice. | tax.iowa.gov (Sales and Use Tax Guide) |

| Kansas | Subject to sales tax. | Sales Tax and Compensating Use Tax (Page 15), § 79-3602(ll) . Admin Reg. 92019-46 |

| Kentucky | Not subject to sales tax if the shipping charges are listed separately on the invoice. | Kentucky Sales Tax Facts (Page 2), KRS 139.010(15)(a)(4), KRS 139.210 |

| Louisiana | Not subject to sales tax if the shipping charges are listed separately on the invoice. | RS 47:301(3)(a), Revenue Ruling No. 01- 007 |

| Maine | Not subject to sales tax if the shipping charges are listed separately on the invoice. |

Title 36, § 1752(14), Business Guide to Sales, Use, and Service Provider Tax |

| Maryland | Not subject to sales tax if the shipping charges are listed separately on the invoice. | |

| Massachusetts | Not subject to sales tax if the shipping charges are listed separately on the invoice. | |

| Michigan | Subject to sales tax. | § 205.51(1)(d), Dept. of Treasury (Sales and Use Tax FAQs) |

| Minnesota | Subject to sales tax. | § 297A.61(7)(a), Sales Tax Fact Sheet 155 |

| Mississippi | Subject to sales tax. | Dept. of Revenue FAQs, Mississippi State Tax Commission Part IV Sales and Use Tax (Pages 16-17) |

| Missouri | Not subject to sales tax if the shipping charges are listed separately on the invoice. | Senate Bill No. 16 |

| Montana | No sales tax. |

N/A |

| Nebraska | Subject to sales tax. | § 77-2701.35, Nebraska Sales and Use Tax Guide on Delivery Charges, Nebraska Sales and Use Tax FAQs |

| Nevada | Not subject to sales tax if the shipping charges are listed separately on the invoice. | NAC 372.101, NRS 360B.480, NRS 360B.290(2), Tax Bulletin SUT 15-0002 |

| New Hampshire | No sales tax. | N/A |

| New Jersey | Subject to sales tax. | Publication ANJ-10, Notice: Sales and Use Tax Rate Change, Bulletin S&U-4, § 54:32B-2(oo)(1), Admin. Code § 18:24-27.2 |

| New Mexico | Subject to sales tax if the Seller is making the payment to the carrier. In other words, shipping is almost always taxable. | § 3.2.1.15(D) (Page 49) |

| New York | Subject to sales tax except for grocery food | § 1101(a)(b)(3), § 1115(n)(3) |

| North Carolina | Subject to sales tax. | § 105-164.3(203), Sales and Use Tax Bulletins (Page 83), North Carolina Dept. of Revenue FAQs |

| North Dakota | Subject to sales tax. | § 57-39.2-01(7), § 81-04.1-01-10 (Page 6) |

| Ohio | Subject to sales tax. | § 5739.01(H)(1)(a)(iv), § 5703-9-52 |

| Oklahoma | Subject to sales tax. | § 710:65-19-70, 68, § 1352(12.a) |

| Oregon | No sales tax. | N/A |

| Pennsylvania | Subject to sales tax. | |

| Rhode Island | Subject to sales tax. | |

| South Carolina | Subject to sales tax. | § 117-310, Dept. of Revenue (FAQs) |

| South Dakota | Subject to sales tax. | Rule 64:06:02:34, South Dakota Dept. of Revenue (Publication) |

| Tennessee | Subject to sales tax. | § 67-6-102 , 1997 Letter Ruling #97-22, Dept. of Revenue FAQs, |

| Texas | Subject to sales tax. | Sec. 151.007, Texas Comptroller FAQs |

| Utah | Not subject to sales tax if the shipping charges are listed separately on the invoice. | § 59-12-102(103)(c)(ii), Tax Commission FAQs |

| Vermont | Subject to sales tax. | § 9701(4)(A), Dept. of Taxes FAQs |

| Virginia | Not subject to sales tax if the shipping charges are listed separately on the invoice. | |

| Washington | Subject to sales tax. | § 82.08.807, WAC 458-20-110(3) |

| West Virginia | Subject to sales tax. | § 11-15B-2(49)(A)(iv), § 110-15-89 (Page 142) |

| Wisconsin | Subject to sales tax. | § 77.51(15b)(b)4, Dept. of Revenue FAQs |

| Wyoming | Not subject to sales tax if the shipping charges are listed separately on the invoice. | § 39-15-105(a)(ii)(A), Dept. of Revenue (Freight and Transportation Charges) |

Sales Tax (USA only)

A sales tax is calculated as a percentage of goods sold and is determined by the location where the sale took place. Sales taxes are administered by each State, County, and District(s) in the USA.

- Use TaxJar to find a sales tax by zip code.

Value-Added Tax (VAT)

A value-added tax (VAT) is a tax that is calculated based on the cost of the goods or service charged. This tax is administered by most countries and usually is targeted at imported items.

- Use Avalara to find the VAT .

| COUNTRY | VAT | SOURCE |

| USA | 0% (although, there is sales tax in most states) | N/A |

| Argentina | 21% | PWC |

| Australia | 10% | TransferWise |

| Bangladesh | 15% | nbr.gov.bd |

| Belgium | 21% | www.belgium.be |

| Brazil | Depends on the State. Average is 17% | KPMG |

| Bulgaria | 20% | www.tmf-group.com |

| Canada | 5% to 15% | www.worldwide-tax.com |

| Chile | 19% | home.kpmg |

| China | 13% | www.tradingeconomics.com |

| Colombia | 19% | Avalara |

| Dominican Republic | 18% | KPMG |

| Finland | 24% | Finland Ministry of Finance |

| France | 20% | www.tmf-group.com |

| Germany | 19% | www.tradingeconomics.com |

| Greece | 24% | www.tradingeconomics.com |

| Hong Kong | 0% | www.worldwide-tax.com |

| Hungary | 27% | Avalara |

| India | 12.5% to 15% | www.worldwide-tax.com |

| Ireland | 23% | Irish Tax and Customs |

| Israel | 17% | Israel Tax Authority |

| Italy | 22% | Ministry of Economy and Finance |

| Jamaica | 16.5% | www.taxsummaries.pwc.com |

| Kenya | 0% or 16% | www.bdo.ea.com |

| Malaysia | 6% | lawofficemalaysia.com |

| Mexico | 16% | Avalara |

| Morocco | 7%, 10%, 14%, or 20% (Standard is 20%) | www.ecovis.com |

| Netherlands | 0%, 9%, or 21% (Standard is 21%) | Government of Netherlands |

| New Zealand | 13% | www.world.tax-rates.org |

| Nigeria | 7.5% | Avalara |

| Norway | 25% | The Norwegian Tax Administration |

| Pakistan | 17% | taxsummaries.pwc.com |

| Panama | 7% (10% and 15% for alcohol and tobacco, respectively) | KPMG |

| Peru | 18% | Avalara |

| Philippines | 0% to 12% | Philippines Bureau of Internal Revenue |

| Poland | 23% | Polish Investment and Trade Agency |

| Portugal | 23% | Avalara |

| Puerto Rico (USA) | 0% | N/A |

| Russia | 10% or 20% (Updated from 18% in 2019) | Federal Tax Service of Russia |

| Saudi Arabia | 15% | KPMG |

| Singapore | 7% | Inland Revenue Authority of Singapore |

| South Africa | 15% | South African Revenue Service |

| Spain | 21% | Spanish Tax Agency |

| Sri Lanka | 15% | Sri Lanka Inland Revenue |

| Sweden | 6%, 12%, and 25% (Standard is 25%) | Swedish Tax Agency |

| Switzerland | 7.7% | Swiss Federal Tax Administration |

| Thailand | 7% | Thailand Revenue Department |

| Ukraine | 20% | Avalara |

| United Kingdom | 20% | GOV.UK |

| Vietnam | 5% or 10% | Ministry of Justice |

| Zimbabwe | 14% | Zimbabwe Revenue Authority |

Are Services Taxed?

Services are taxed based on the service provider’s country. In most countries, services are taxed at the Value-Added Tax (VAT).

In the USA, only four (4) States charge taxes on general services:

- Hawaii – 4% (tax.hawaii.gov)

- New Mexico – 5% and will be 5.125% on July 21, 2021 ( www.avalara.com)

- South Dakota – 4.5% (dor.sd.gov)

- West Virginia – 6% (tax.wv.gov)

Are You an Employee?

There are two (2) classes of employment; employees and independent contractors.

Employees

An employee, or “W-2 employee” in the USA, is an individual who performs a service on an employer’s behalf in exchange for payment, commonly hourly pay. The employer can control what services to complete and how it will be done. Also, the employer can control, in most cases, where the employee performs the services.

- IRS Form W-2 – Required to be completed by the employee and given to the employer prior to employment.

Independent Contractors

An independent contractor, or “1099 contractor” in the USA, is an individual who performs a task for an employer in exchange for payment, commonly a fixed price. The employer cannot control how the task will be completed but only the result of the work. The employer also cannot control, in most cases, where the employee performs the services unless the work is at a specific location.

- IRS Form W-9 – Required to be completed by the independent contractor and given to the employer prior to employment.

Employee vs Independent Contractor

Each State determines ultimately determines its definition of an employee. Although, most States rely on the IRS 20-Point Test to determine if an individual is an employee. The table below is an overview of the two (2) classes of employment:

| Employer: | Employee | Independent Contractor |

| Pays Withholding Taxes (social security, medicare, unemployment, etc.) | √ | X |

| Provides Health Insurance | √ | X |

| Provides 401(k) Matching | √ | X |

| Provides PTO (Paid Time Off for vacation, sick leave, etc.) | √ | X |

| Provides Overtime Pay | √ | X |

| Controls How Work is Performed | √ | X |

| Controls Where Work is Performed | √ | X |

| Controls When Work is Performed | √ | X |

| Controls Results of Work | √ | √ |

How to Make an Invoice

The following guide is how to make a generic invoice.

- Download: Adobe PDF, MS Word (.docx), MS Excel (.xlsx)

- Export: Google Docs, Google Sheets, Dropbox, MS OneDrive

- Online: Invoice Generator

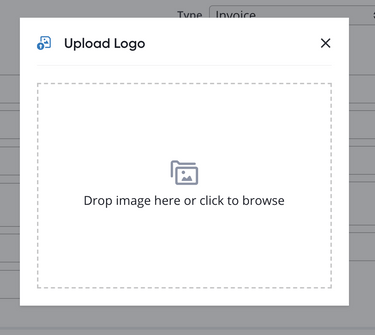

Step 1 – Upload a Logo

Upload a logo from your device that will be placed on the invoice. It’s best to use a logo with square dimensions.

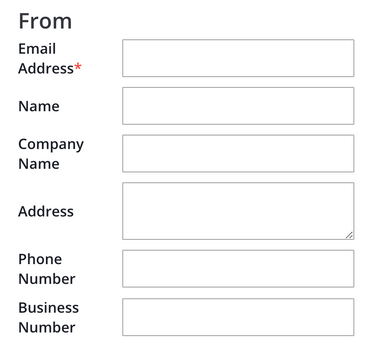

Step 2 – Company Details

- Email Address* (required*)

- Name

- Company Name

- Mailing Address

- Phone

- Business Number

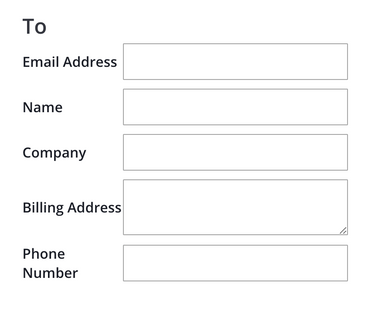

Step 3 – Client’s Details

- Email Address

- Name

- Company Name

- Billing Address

- Phone Number

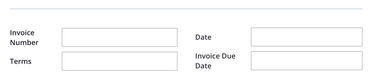

Step 4 – Invoice Details

- Number (#)

- Invoice Date

- Payment Terms (payment is due by)

- Invoice Due Date

Step 5 – Description of Goods / Services

- Goods/Services Description

- Quantity/Number (#) of hours

- Cost per Item/Per Hour ($/hr)

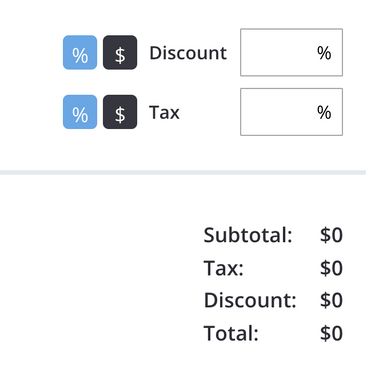

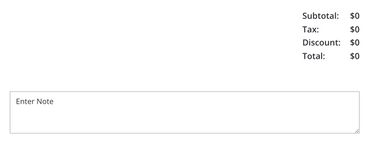

Step 6 – Calculate Total

- Subtotal

- Taxes (if any)

- Discount (if any)

- Shipping (if any)

- Total Amount

Step 7 – Notes / Comments

- Penalties / Interest if payment is not made.

- Installment dates (if any)

- Bank Information (so the customer can initiate a wire)

- Credit Card Details (so the customer can pay by writing their credit card information)

- PayPal E-Mail

- Venmo Profile

- CashApp Hashtag #

- Bitcoin Address (receiving)

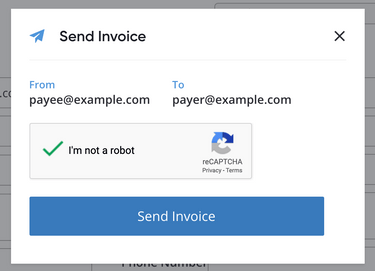

Step 8 – Send to the Client

- E-Mail (sending through InvoiceMaker)

- Standard Mail (USPS, FedEx, etc.)

- Fax

Maximum Late Fee | Penalties

Below are the maximum penalties that can be charged if an invoice is not paid. Any late fees must be written in the invoice at the time of sending it to a client. The late fee is calculated by the total amount owed multiplied by the interest rate (%) on a per annum basis.

By Country (Top 50)

| COUNTRY | MAXIMUM PENALTY | SOURCE |

| USA | 0%; however, most states implement a sales tax | N/A |

| Argentina | No maximum rate | N/A |

| Australia | 48% from interested collected plus other fees | Consumer Credit Act in NSW and ACT |

| Bangladesh | 6% | Trading Economics |

| Belgium | No maximum rate | N/A |

| Brazil | 6.5% | Banco Central Do Brasil |

| Bulgaria | No maximum rate | N/A |

| Canada | 60% | § 347 of the Criminal Code |

| Chile | 36% | Science Direct |

| China | 36% | Bloomberg |

| Colombia | 33% | Borradores de Economia |

| Dominican Republic | No maximum rate | Latin Lawyer |

| Finland | 7 percentage points higher than the interest rate applied by the European Central Bank | Finland Interest Act (633/1982) |

| France | An annual rate higher than 1/3 the average percentage rate applied by credit institutions is usury | French Consumer Code Article L313-3 |

| Germany | 5 percentage points above the basic rate of interest (currently 3.62%) | Section 288(1) of German Civil Code |

| Greece | 2 percentage points above the maximum contractual interest rate. | E-Justice |

| Hong Kong | 60% | Hong Kong Legistlation Cap. 163, Section 24(1) |

| Hungary | No maximum rate | N/A |

| India | At such rate as the Court deems reasonable | India Code Usury Laws Repeal Act, 1855, Section 2 |

| Ireland | 187% to 287% | Consumer Credit Act |

| Israel | 13% per annum, 17% per annum on arrear interest | Banking Regulation in Israel: Prudential Regulation versus Consumer Protection |

| Italy | 25% plus 400 basis points (or exceed average market rate by 800 basis points) | Lexology |

| Jamaica | 6% | Money Lending Act |

| Kenya | No maximum rate | N/A |

| Malaysia | 12% for secured loan, 18% for an unsecured loan | Moneylenders’ Act 1951, Section 17A |

| Mexico | No maximum rate | N/A |

| Morocco | No maximum rate | N/A |

| Netherlands | No maximum, except on consumer credit loans | Practical Law |

| New Zealand | No maximum rate | Commerce Commission New Zealand |

| Nigeria | 48% | Practical Law |

| Norway | No maximum rate | N/A |

| Pakistan | Interest not permitted under Pakistani laws for domestic lending | Practical Law |

| Panama | No maximum rate | N/A |

| Peru | No maximum rate | N/A |

| Philippines | No maximum rate | N/A |

| Poland | 4 times the pawn loan rate of the National Bank of Poland | Polish Civil Code Article 359(2¹) |

| Portugal | 7% or 9% (depending on in rem guarantee) | Law and Practice Portugal, Section 4.3 ( Full PDF) |

| Puerto Rico (USA) | 6% | Financing USA |

| Russia | Cannot exceed more than twice usual applicable rate | Civil Code Chapter 42, Section 1, Article 809(5) |

| Saudi Arabia | No maximum rate | N/A |

| Singapore | 4% per month | Singapore Ministry of Law |

| South Africa | 10% | National Credit Act, Chapter 5, Part C (105) |

| Spain | No maximum rate | N/A |

| Sri Lanka | 20%, 18%, or 15% | Sri Lanka Money Lending Ordinance Section 4(2) |

| Sweden | No maximum rate | N/A |

| Switzerland | 10% or 12% | Swiss Credit Consumer Act, Section 3 |

| Thailand | 15% | Thai Civil and Commercial Code Book 3, Chapter II, Section 654 (Full PDF) |

| Ukraine | No maximum rate | N/A |

| United Kingdom | No maximum for payday loans | Credit Unions Act 1979 |

| Vietnam | 20% | Vietnamese Civil Code, Chapter XVI, Section 4, Article 478(1) (Full PDF) |

| Zimbabwe | Not specifically defined | Moneylending and Rates of Interest Act, Chapter 14:14, Section 8 (Full PDF) |

Usury Rates by State (USA)

| State | USURY RATE | SOURCE |

| Alabama | 6% maximum for verbal agreements, 8% for written agreements. | § 8-8-1 |

| Alaska | Cannot exceed 10% or 5 percentage points above Federal Reserve interest rate; 10.5% if loan is more than $25,000. | § 45.45.010 |

| Arizona | 10% unless agreed upon in a written contract. | § 44-1201 |

| Arkansas | May not exceed the applicable rate of interest (17%) set forth in Section 3 of the Arkansas Constitution, Amendment 89 . | § 4-57-104 |

| California | 7% for money, goods, or things in action; 10% for money, goods, or things in action for personal, family, or household purposes; or the greater of 10% or 5% + the prevailing rate established by the Federal Reserve Bank of San Francisco for any other use. | Article XV |

| Colorado | Maximum is 45% per annum. If no written agreement exists, interest rate may not exceed 8%. | § 5-12-103 |

| Connecticut | Interest rate may not exceed 12%. | § 37-4 |

| Delaware | Maximum rate of interest is 5% over the Federal Reserve discount rate. No limitations on interest rates for loans exceeding $100,000. | § 2301 |

| Florida | 18% unless loan exceeds $500,000, in which case the rate of interest can be 25% (in accordance with § 687.071(2)) | § 687.03 |

| Georgia | Maximum interest rate is 7% if no written contract exists; 16% on loans of $3000 or less; and any rate of interest may be established by parties to a written contract for loans of $250,000 or more. | § 7-4-2 |

| Hawaii | 10% without a written contract; 12% for consumer credit transactions; and 10% on judgments recovered in any civil suit. | § 478-2, § 478-3, and § 478-4 |

| Idaho | Maximum of 12% if no contract exists. 5% plus base rate on money due on judgments. | § 28-22-104 |

| Illinois | 5% without a written contract, 9% maximum if agreed upon by parties to a written agreement. | 815 ILCS 205/4 and 815 ILCS 205/1 |

| Indiana | Interest rate may not exceed 8%. Consumer loans may be charged a maximum of 25%. | § 24-4.6-1-102 and § 24-4.5-3-201 |

| Iowa | 5% with no written contract; for written agreements, 2 percentage points above the monthly average 10-year constant maturity interest rate of US government notes and bonds. | § 535.2(1) and (3)(a) |

| Kansas | 10% maximum if no other interest rate was agreed upon. Bonds, bills, promissory notes, or other written instruments may stipulate a maximum of 15%. | § 16-201 and § 16-207 |

| Kentucky | Legal rate of interest is 8%. If a written agreement exists, the rate may be increased to 4% in excess of the discount rate on 90-day commercial paper in effect at the Federal Reserve Bank OR 19%, whichever is less, on loans of $15,000 or less. Any rate is permitted for loans in excess of $15,000. | § 360.010 |

| Louisiana | Maximum interest rate is 12% per annum. | § 9:3500(C)(1) |

| Maine | Without a written contract, maximum interest rate is 6%. Maximum rates for consumer credit sales are 30% for first $1,000, 21% between $1,000 and $2,800, 15% for more than $2,800, and 18% on all unpaid balances. | 9-B § 432 and 9-A § 2-201 |

| Maryland | Maximum is 6% unless a written agreement is established, in which case interest rate can be up to 8%. | § 12-102 and § 12-103 |

| Massachusetts | 6% maximum interest rate with no written agreement. Charging more than 20% interest is considered criminal usury. | Ch. 107 § 3 and Ch. 271 § 49 |

| Michigan | 5% if no written agreement exists, 7% if an agreement is made between the parties in writing. | § 438.31 |

| Minnesota | Interest rate is 6%, unless a different rate is agreed upon in writing. Interset rate may not exceed 8%. | § 334.01 |

| Mississippi | Maximum interest rate is 8% per annum. “Contract rate” may not exceed the greater of 10% or 5% above the discount rate on 90-day commercial paper in effect at the Federal Reserve Bank. | § 75-17-1 |

| Missouri | Rate of interest may not exceed 10% if a written instrument exists, unless the “market rate” is higher. | § 408.030 |

| Montana | Interest rate is 10% per annum. Parties may agree in writing to a maximum interest rate of 15% OR 6 percentage points above prime rate established by Federal Reserve System, whichever is greater. | § 31-1-106 and § 31-1-107 |

| Nebraska | Maximum interest rate is 16%. | § 45-101.03 |

| Nevada | Parties may agree in writing to any interest rate. Without a written agreement, the rate shall not exceed the prime rate at the largest bank in Nevada. | § 99.040 |

| New Hampshire | Maximum rate of interest is 10% | § 336:1 |

| New Jersey | Maximum rate of interest is 6% without a contract. Maximum rate of interest with a written contract is 16%. | § 31:1-1 |

| New Mexico | Rate of interest shall not exceed 15% without a written contract. | § 56-8-3 |

| New York | Interest rate is 6% per annum unless a different rate is prescribed in NY CLS Banking, in which case legal interest rate is 16%. | Gen. Oblig. § 5-501 and Banking § 14-A |

| North Carolina | Legal rate of interest is 8%. | § 24-1 |

| North Dakota | Maximum interest rate is 6%. Maximum contract rate is 5.5% higher than current cost of money but no less than 7%. | § 47-14-05 + 09 |

| Ohio | Written contracts may not stipulate a rate of interest exceeding 8%. | § 1343.01 |

| Oklahoma | Parties may agree to any rate permitted by state law; otherwise, 6% is the maximum rate without a written contract. | § 15-266 |

| Oregon | Maximum interest rate is 9%. | § 82.010(1) + (3) |

| Pennsylvania | Maximum interest rate is 6% for loans of $50,000 or less. | 41 P.S. § 201 |

| Rhode Island | Interest rate may not exceed the greater of 21% or the alternate rate of 9 percentage points plus the domestic prime rate. | § 6-26-2 |

| South Carolina | Legal rate of interest is 8.75%. | § 34-31-20 |

| South Dakota | 12% where no contract exists; no interest rate limit if parties agree in writing. | § 54-3-4 and § 54-3-16(3) |

| Tennessee | Unless the parties agree in writing, the maximum interest rate is 10%. | § 47-14-103 |

| Texas | Unless the parties agree in writing, the maximum interest rate is 10%. | § 302.001(b) |

| Utah | Unless the parties agree in writing, the maximum interest rate is 10%. | § 15-1-1 |

| Vermont | Maximum rate of interest is 12%. | 9 V.S.A. § 41a |

| Virginia | Legal rate of interest is 6%. If parties agree in writing, the interest rate may be a maximum of 12%. | § 6.2-301 and § 6.2-303 |

| Washington | Rate of interest may not exceed 12% OR 4 percentage points above the equivalent coupon yield of the average bill rate for 26-week treasury bills. | § 19.52.020 |

| West Virginia | Parties may agree to a maximum interest rate of 8%; otherwise, the legal interest rate is 6%. | § 47-6-5 |

| Wisconsin | Legal interest rate is 5%. | § 138.04 |

| Wyoming | Maximum interest rate is 7% if no agreement exists. | § 40-14-106 |

How Long to Keep an Invoice?

At least 3 years for USA residents. According to the Internal Revenue Service (IRS), an individual or company is required to keep an invoice under the following circumstances:

- 4 years for invoices related to the payment of employees. The 4-year period begins after the date the tax is due or is paid, whichever is later;

- 6 years for invoices that are not reported on your income taxes and represent more than 25% of gross income;

- 7 years if filed the invoices are related to a claim for a loss from worthless securities or bad debt deduction; and

- Indefinitely if the invoice was made in a tax year where no filing was made or if a fraudulent return was filed.